Another Way to Sell a Home

My goal is to provide the home seller with the valuable knowledge that there are other viable options that can be considered when selling a home, options that may very well be a better fit for their particular situations rather than through the traditional process of banks and brokers. I look forward to having a conversation with you and see if This Guy Buys houses can be a good fit as your home selling partner.

Please take a look at our 5 videos below as they will help you better understand our process.

Thank you,

Jhamel D. Jones Sr.

WE WANT TO BUY YOUR PROPERTY

"If you’re looking to get FULL PRICE for your House, AND want to Consider It Sold today, we are your Best Option."

How Does Selling My Property with Terms Work and Why is it fast becoming the seller’s 1st CHOICE When Selling Their Home!

We find ourselves answering this question daily so below is a summary of why selling your home with terms might be your best option. We’re a small family company looking to buy 4+ homes every month. The market is constantly changing and in order to get Top Dollar for your property, sometimes you’ve got to change with it and be aware of your options.

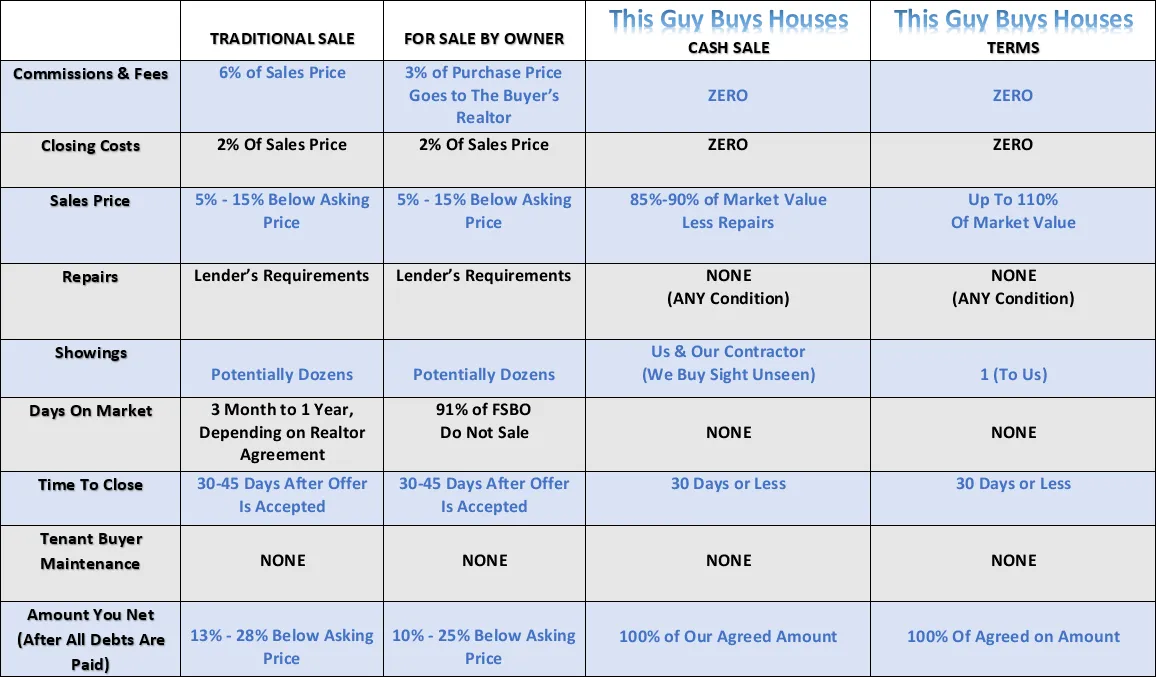

Approximately 75-82% of the buyers cannot qualify TODAY for financing. That is a National number that is not improving. Alternatively, other buyers with good credit are looking for a way to buy now while they save more instead of renting while they save. Yet another group of people need seasoning as self-employed individuals. If you are selling with a Realtor or by owner, you are only marketing to 18-25%+- of the market. A smaller pool of buyers will obviously produce a lower price and less money for you.

We can buy homes all cash with a quick close, but that is typically for a property in need of repairs and/or for property owners who, for one reason or another need to sell fast. All cash offers usually come with a lower offer. We more frequently purchase with a lease purchase or owner financing – both of those with a short-term cash out for you at Full Market Value. When we meet, we can discuss what option is the best fit.

We are NOT Realtors offering a service and you will not pay us any fees. Many think these types of purchases are only for low-end homes or distressed sales. We can actually handle homes from $550,000 up to the Multi-Million Dollar range.

There are many people out there who have cash to put down, have good incomes, but have had life events or other challenges that caused their credit to go down. Things like divorce, death in the family or seasoning needed for a new business. We maintain a qualified database of these buyers.

The lease purchase means we are 100% responsible for maintenance, repairs, taxes, etc. after 30 days. If your insurance and taxes are currently escrowed, the monthly lease will cover them. Your equity is locked in, predetermined ahead of time and will not change.

If you have no mortgage currently, we can even pay a premium above market value!

Who is this not a fit for?

This isn’t a fit for anyone who has equity in the home that they need NOW to buy another home. It will still work but you would have to do a refinance, pull out cash needed and then secure a lease purchase with us to cover the new underlying mortgage.

What if I still have my loan and want to go buy another home and get a mortgage to do so?

Banks and mortgage companies vary on this one and you should shop around. I’ve seen them count your lease payment anywhere from 75%-100%. For example, if your mortgage payment is $1000 and you are collecting only $1000 on your lease, if they are only counting 75%, you will be credited for $750 monthly income as far as your debt to income qualifying ratio and that means you have $250 net debt. If they count 100% of your lease income, it’s a break even and will not at all affect you qualifying for a loan. There is a simple solution for this as well, which we can discuss.

We’re a small family company looking to buy 4+ homes every month. The market is constantly changing and in order to get Top Dollar for your property, sometimes you’ve got to change with it and be aware of your options.

Approximately 75-82% of the buyers cannot qualify TODAY for financing. That is a National number that is not improving. Alternatively, other buyers with good credit are looking for a way to buy now while they save more instead of renting while they save.

We can buy homes all cash with a quick close, but that is typically for a property in need of repairs and/or for property owners who, for one reason or another need to sell fast. All cash offers usually come with a lower offer. We more frequently purchase with a lease purchase or owner financing – both of those with a short-term cash out for you at Full Market Value.

We are NOT Realtors offering a service and you will not pay us any fees. Many think these types of purchases are only for low-end homes or distressed sales. We can actually handle homes from $550,000 up to the Multi-Million Dollar range.

There are many people out there who have cash to put down, have good incomes, but have had life events or other challenges that caused their credit to go down. Things like divorce, death in the family or seasoning needed for a new business. We maintain a qualified database of these buyers.

The lease purchase means we are 100% responsible for maintenance, repairs, taxes, etc. after 30 days. If your insurance and taxes are currently escrowed, the monthly lease will cover them. Your equity is locked in, predetermined ahead of time and will not change.

If you have no mortgage currently, we can even pay a premium above market value!

Who is this not a fit for?

This isn’t a fit for anyone who has equity in the home that they need NOW to buy another home. It will still work but you would have to do a refinance, pull out cash needed and then secure a lease purchase with us to cover the new underlying mortgage.

What if I still have my loan and want to go buy another home and get a mortgage to do so?

Banks and mortgage companies vary on this one and you should shop around. I’ve seen them count your lease payment anywhere from 75%-100%. For example, if your mortgage payment is $1000 and you are collecting only $1000 on your lease, if they are only counting 75%, you will be credited for $750 monthly income as far as your debt to income qualifying ratio and that means you have $250 net debt. If they count 100% of your lease income, it’s a break even and will not at all affect you qualifying for a loan. There is a simple solution for this as well, which we can discuss.

Other Advantages:

· Top sales price

· Stops the money hemorrhage of mortgage payments if applicable.

· All maintenance is our responsibility- Completely hands off for you.

· You still enjoy tax advantages and depreciation if applicable.

· No advertising dollars out of your pocket.

· No fees out of your pocket.

· We don’t care what kind of mortgage you have.

· No inspections and negotiating.

If you’re still looking to get FULL PRICE for your Home, we are your Best Option.

We Look Forward to Purchasing Your Home!

Another Way to Sell a Home

My goal is to provide the home seller with the valuable knowledge that there are other viable options that can be considered when selling a home, options that may very well be a better fit for their particular situations rather than through the traditional process of banks and brokers. I look forward to having a conversation with you and see if This Guy Buys Houses can be a good fit as your home selling partner.

Please take a look at the 5 videos below as they will help you better understand our buying process.

Thank you,

Jhamel D. Jones Sr.

WHAT'S A LEASE PURCHASE?

WHAT IS THE LEASE PURCHASE PROCESS?

WHAT IF I DON'T HAVE A MORTGAGE?

WHAT IS THE DIFFFERENCE BETWEEN A LEASE PURCHASE AND AN OWNER FINANCE PURCHASE?

IF MY HOUSE IS ONLY WORTH WHAT I OWE, CAN I SELL IT WITHOUT COMING OUT OF POCKET?

I LIKE THE IDEA, BUT WHAT IF I DON'T WANT YOU IN THE MIDDLE?

WHAT IS AN ASSIGN OUT?

Need To Sell Your House Fast?

Enter The Address And Get An Offer Today

© 2022 This Guy Buys Houses - All Rights Reserved.

This Guy Buys Houses, and affiliated or subsidiary and Parent companies are not real estate brokers or agents. This Guy Buys Houses, is a real estate investment company. All properties are either owned by us, or the company has a purchase contract and/or option with the owner of the property, which we may assign to third parties. This Guy Buys Houses is not a real estate brokerage and does not provide REALTOR® services to the public or to any of the parties to which it has contractual relationships.